This article was produced in association with Sportradar.

Data is one of the most exciting and dynamic spheres of the sport business in 2017, with multi-billion-dollar deals highlighting its importance to rights-holders, partners, the media and fans. Sportradar has landed a number of high-profile agreements with major leagues such as the NBA, NFL and NHL, but governing bodies and federations of all sizes should consider how data can play a leading role in driving engagement, building audience and, ultimately, increasing revenue.

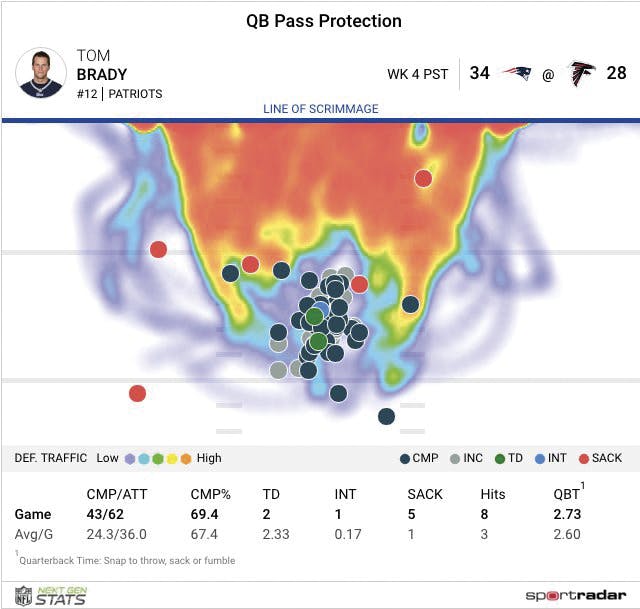

When we talk about sports data, we are considering a subject that is shifting all the time. Like a tricky winger on the football field, it is hard to pinpoint. Some years ago it might have meant something as simple as goals for and against in a league table; then shots on target could be accurately counted and displayed by newspapers or live during a television broadcast. Nowadays, in the Data 2.0 era, our NFL Next Gen Stats (NGS) uses information collected by sensors on players’ shoulder pads, allowing us to give accurate readings of a wide receiver’s yards rushed or create the Pass Protection widget that provides a heat map (pictured) illustrating the protection that a quarterback has throughout a game.

Every sport has its characteristics and it is the job of the data partner and the rights-holder to look closely at what is meaningful and how it can be used. It could be something as binary as a point in tennis or handball, or a little more obscure, perhaps the exact route that a runner has taken while completing a course. Fans love this rich data and if the public loves it, so will advertisers and partners. Sportradar recently worked with the International Ski Federation (FIS) and its sponsor, Audi, to produce a fun platform that allowed fans to track the competitors’ run and compare them to the auto manufacturer’s range of vehicles.

Changing times

These are changing times. Consumption of sport is completely different now to five years ago, and unrecognisable from 10 or 20 years back. Television is perhaps still paying the bills at present thanks to those huge rights deals that are reported every couple of years. At present, data maybe accounts for around just two per cent of revenue for a major organisation such as the NFL, but this could be as high as 30-40 per cent in the very near future.

This change is coming because habits are changing. Yes, there are still those sports fans who rely solely on the broadcast of Monday Night Football, but that generation is decreasing every year. As with many sectors, mobile has changed everything and we will continue to see a shift away from traditional broadcast models in the coming years. The second-screen viewer has been talked about for some time and the rise of that ‘millennial’ consumer means a change in strategy for all those involved in sport business. They want more than just the prescriptive decision as to which game they should watch. They want choice and a more holistic experience that includes data that helps them to appreciate more broadly the drama that is unfolding as well as different ways of connecting to the action in a more personalised way. Mobile users also expect free content and that means rights-holders must work out how to exploit new revenue streams to pay for their competitions.

PICTURE: Carsten Koerl

Sports data for all

The key thing to realise is that sports data is for all. It’s not just the NFL or the Premier League and their huge deals. I truly believe that data offers a huge opportunity to all sports as they can take advantage of a changing market to boost not just their revenues, but also exposure and fan engagement. I’m not alone in this thinking. Just recently I attended the MIT Sloan Sports Analytics Conference where tech giants such as Microsoft, Intel and SAP were also present, curious as to what role they will play in a sector with such huge potential.

The change in consumption is already having a huge effect on rights-holders and federations whose events have previously struggled for exposure, because TV executives were only interested in the NBA Finals or the Champions League. Now these organisations have the opportunity to reach new and existing fans through live streaming and OTT services.

Sportradar sees the future of sports broadcasting as a comprehensive, cross-functioning service that fuses rich data with our high-quality, high-definition production capabilities. Our role is to be the middle man, linking the federations, their existing and potential partners, and the fans out there who are eager to consume fantastic content from their favourite sports. Federations should not underestimate the value of their assets. They should also not overestimate the cost of exploiting these rights, with Sportradar offering some programmes with no up-front cost.

We must look beyond the stadium roof. The sky’s the limit. When I founded Sportradar in 2001 we had just three employees, but now we have a workforce of 1,953 who service 800 partners in over 80 countries worldwide. We value our innovation as much as our experience and expertise, and we believe that there is a bright future for all forward-thinking sports, no matter their size.