Since Euroleague Basketball and IMG joined forces in 2015, the popularity of European basketball has reached new heights.

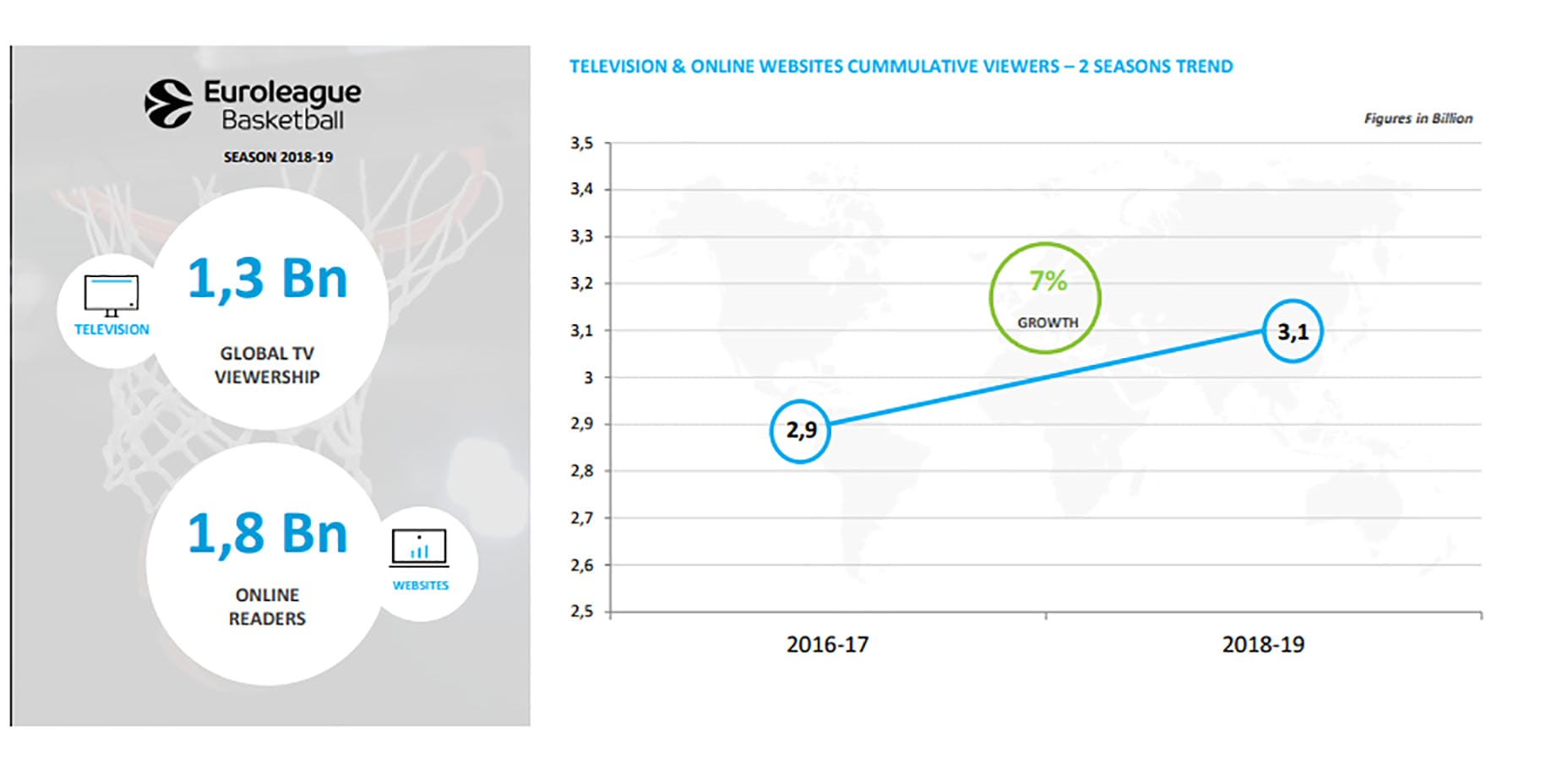

Last season, over 1.3bn viewers tuned in to more than 25,000 Euroleague broadcasts in 214 different countries and territories. Articles about Euroleague Basketball attracted almost 1.8bn pageviews. Video content attracted over 280m views, and social media garnered 58m likes, shares and comments.

In fact, Euroleague social media content had a higher engagement rate than the Uefa Champions League, the English Premier League and the NBA during 2018-19. In other words, Euroleague fans are incredibly passionate.

With over 25,000 Euroleague broadcasts around the world each season, and a huge amount of online content, the competition reaches men, women and children of all ages. As a result, Euroleague has completely changed how its partner brands access that audience, enabling them to pick and choose the Euroleague content that reaches their target demographic.

As Euroleague produces thousands of hours of live content, social media content and live activation inventory, it has switched from a platform-based offering to a demographic-based offering.

Thanks to extensive consumer research conducted by Euroleague, IMG and Nielsen, partners can now zero in on their chosen demographics, receiving customised packages of inventory to ensure their partnership with Euroleague is as effective as possible.

This means that a brand wanting to reach men aged 18-34 will no longer be offered a package restricted to specific platforms, such as live games or a single social media platform. Instead, brands now receive a tailored package of inventory that reaches the desired audience.

“A 40-year old woman is going to consume differently from the 25-year-old basketball player. We can now choose specific content platforms – whether that’s a particular game or a series of specially-created pieces of content – that will engage with specific demographics. We can then give that to the partners that want to engage with that demographic,” says Jose-Luis Rosa-Medina, Euroleague’s senior director of corporate partnerships.

“We have a wide variety of sponsors; some are pan-European brands, some are national brands,” Rosa-Medina says. “But to be able to service those partners’ individual needs, we needed a structure that had more resources, more manpower to service those accounts, but most of all the right expertise.“

Bigger, Better

In order to make that happen, Euroleague has restructured and expanded its sponsorship staff to deliver these improvements.

A major step was the creation of a new Partnership Activation and Platforms department to act as an in-house agency. Supporting the sales team at early stage conversations and the account management team with activation strategy, the department creates solutions to brand partner needs and is an important piece in making partnerships work harder in terms of connection with the fans.

The work hasn’t stopped there.

“We’ve reinforced our sales team to enhance our expertise in brand solutions with a senior hire from Mediaset’s new creative department. We’ve also reshaped the accounts team,” says Rosa-Medina. “For us, the account managers are the custodians of the EuroLeague brand and we needed experienced people that know the ecosystem and know basketball to help our partners navigate it and make sure every partner has the right tools to create the deep connections with fans we’re aiming for.”

This growth in staff numbers and expertise, alongside the focus on consumer research, has propelled Euroleague’s sponsorship programme to new heights – sponsorship revenue has almost doubled since the creation of Euroleague Ventures, the joint venture with IMG.

“Over the last two seasons we’ve deployed these tools to more completely profile our fans around sponsorship categories, allowing us to define segments of the fanbase that we know are more inclined to buy certain products and communicate with them directly. Our partners covet this highly,” says Rosa-Medina.

Tailored to Fit

One major development since the creation of the joint venture has been the creation of bespoke content to support partnerships big and small. This varies from in-arena activations and sponsored social media content, to completely bespoke events tailored to the brand’s needs.

Between January and March this year, Euroleague and software solutions company SAP created the SACkathon, a competition for data analysts and data scientists. Participants were given access to EuroLeague Statistics and were asked to tell stories via data visualisation, using the SAP Analytics Cloud (SAC). The winner received €2,000 and a three-month working collaboration with Euroleague to develop advanced statistics to be used across all content and platforms.

Along with bespoke Euroleague content, brands are free to create their own Euroleague-related content for the purpose of marketing their products. EuroLeague offers league, team and player IP in one single package, on either a global or country-by-country basis, resulting in a marketing tool-kit available to partners that can be shaped to fit almost any set of brand objectives.

A prime example of this is Turkish Airlines’ ‘Enjoy the Flight’ campaign, which combined television and online advertisements for the brand as well as short-form Euroleague content. This synergy was made possible by the unified package of IP – something that no other pan-European sports league can offer.

Euroleague now has 27 partner brands. Thanks to demographic-focused marketing and inventive content solutions, those 27 brands get to reach their intended audience without being crowded out. Every Euroleague partner has the chance to take the spotlight.

Media Matters

While the growth of Euroleague’s sponsorship revenue has been remarkable, the growth of its media-rights revenue has been exceptional since 2016-17. Media revenue had grown by 140 per cent by then end of 2018-19, driven by exponential increases in core markets and growth markets alike.

Euroleague expects year-on-year growth of about 20 per cent from 2018-19 to 2019-20. This is due to a new deal in Turkey with beIN Sports, an extension to its deal in Greece with Nova and the beginning of its most-lucrative deal, in Spain with DAZN.

The competition’s revenue growth in Spain has been particularly impressive. Media-rights revenue from the country has increased by about 400 per cent since 2015-16, confirming the competition’s popularity and its importance to Spanish pay-television customers.

The growth of basketball in Turkey over the past five years has been a direct result of the excellent performance of Turkish clubs in Euroleague. Euroleague’s recent media-rights deal in Turkey with beIN produced a rights fee increase of almost 70 per cent, making it one of the only sports properties in the world to produce consistent revenue growth in the country.

In Greece, Euroleague is performing even better, securing overall media-rights revenue growth of almost 150 per cent since 2016-17.

“We’ve done research about what fans think about our clubs, what they think about the Euroleague, how they value Euroleague as part of their pay-television subscription, how it influences their decision to pay for subscription packages,” says Xavier Bidault, commercial director of basketball at IMG.

He continued: “Euroleague gives broadcasters a really premium property and is a subscription driver in core markets. It really is something people care about, and that’s due to the strength of our local clubs in those markets. Olympiacos and Panathinaikos are cultural institutions in Greece. Fenerbahce and Anadolu Istanbul are really important to local communities in Turkey. Our sales process has been about trying to show the value of Euroleague for different partners.”

The media-rights revenue growth Euroleague has seen over the past four years has been the most eye-catching element of its finances, but there is a primary catalyst behind the competition’s growth across all verticals.

Switching up the Format

The competition’s format change in 2016-17, which transformed Euroleague from a 24-team soccer-style tournament to a 16-team (now 18-team) round-robin league with a regular- and post-season. On top of this, 11 of the 16 teams received 10-year ‘A-Licences’, guaranteeing their participation until the end of 2025-26.

The change has given broadcasters and brands certainty, giving them the confidence to invest more over longer periods of time. The format means that every participating team will play at least 34 regular season games and will play each team twice, home and away.

Euroleague chairman, chief executive and president Jordi Bertomeu regards this change as the most important event in Euroleague’s history.

“Our opinion is that the change of the format was fundamental,” Bertomeu says. “The joint venture was at least of the same importance, but without the change of the format, it would have been very difficult to tell a different story to our partners.”

Bidault says: “The format has been very important to how we’ve commercialized the rights, and in the way we’ve structured our rights. I think the primary reason for the growth is consistency. Every year you can guarantee the same matchups from one country to another, the same number of games for the big teams. And I think from a media perspective it really helped the storytelling as well. It’s helped to build those big rivalries and the narrative behind them from one year to another.”

After reducing the number of teams in the competition to 16 in order to increase the quality of the competition, European basketball’s rapid growth is enabling expansion. Germany’s Bayern Munich and France’s ASVEL have joined Euroleague on two-year wildcards from 2019-20, spearheading the competition’s growth in western Europe. Soon, Euroleague will have teams in every major European market, including the United Kingdom.

“We are entering the second three-year cycle of the joint venture and our ambition is that at the end of it, we will have a stable presence in the UK market, we will have developed the business in Germany and have a second team in either France or Italy,” Bertomeu says. “This is our goal now. Those decisions will be fundamental if we want to not only to increase the business, but also to balance our business in terms of territories and move more from the Mediterranean area to the north of Europe.”