After a two-month “time out”, live sport has blinked back into action. In Germany, the Bundesliga became the first major European soccer league to restart its season, and across the pond the NASCAR Cup Series returned to the track. The vast global audiences that tuned into both offered up a striking symbol of the solace provided by sport’s reappearance.

As the sport landscape gradually shifts back to normality, we looked at the number of new sponsorship deals that have been signed since the beginning of the year.

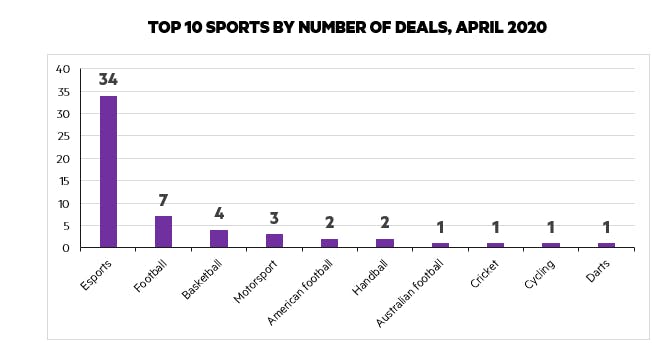

In April 2020 a total of 61 new deals were signed globally. That comes in stark contrast to April 2019 where a total of 200 global deals were signed – a 70-per-cent drop that clearly shows the impact of the pandemic.

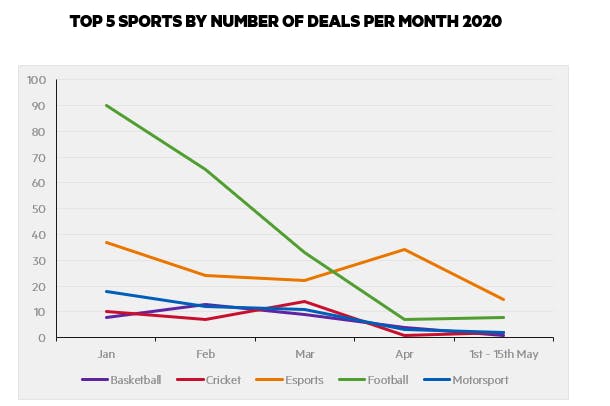

From the diagram below you can see most sports have suffered a decline in new sponsorship investment, with football being hit the hardest. Where there were ninety deals signed in January, just seven were completed in April.

One industry that has experienced an uplift in sponsorship investment during lockdown, however, is Esports. In April alone, 56 per cent of new sponsorship agreements within sport could be attributed to Esports.

Due to the lack of live sport and appointment-to-view, gaming and esports has thrived, with streaming platform Twitch reporting a 31-per-cent uplift in viewership across March. Twitter, meanwhile, reported a 71-per-cent increase in conversation volume and Verizon experienced a 75-per-cent increase in gaming usage since quarantine began. To capitalise on this trend F1, NASCAR and Formula E moved seamlessly into the esports space with slick production quality and highly engaging content.

The recent F1 Virtual Spanish Grand Prix, for instance, was almost ninety minutes long, shot in a studio environment and included talent such as Fernando Alonso, all of which combined to earn the video hundreds of thousands of views.

As the virtual gaming and esports sphere gains further traction, brands have been quick to follow. BMW recently entered into multi-million dollar partnership agreements with Cloud9, Fnatic, FunPlus Phoenix, G2 Esports, and T1 Entertainment & Sports and will use these partnerships to leverage the scale of streaming viewership and social to entertain and engage target audiences.

E-commerce group Lazada Indonesia also signed a new agreement with EVOS Esports, a deal loaded with digital assets that will help tap into the Millennial and Gen Z fan base. Activations will include flash sales, talent auditions, shopping experiences, livestreams and games.

My colleague Beth Maguire, Insights Manager, shared her thoughts on how brands and rights-holders can set themselves up for success during this time. She said that brands are appearing to generate value through the ever-increasing growth of esports interest, due the fact the virtual space hasn’t been disrupted. As sport heads to resumption behind closed doors, rights-holders will need to innovate their offering and create new service offerings to facilitate partnership renewals and acquisitions.

But all is not lost for the more traditional rights-holder.

As esports thrives and we move into a world of closed-door sport, what lessons can traditional rights-holders learn? How can they innovate and adapt to convert more deals and drive greater value for brand partners?

Fulfilling human needs

Covid-19 has pushed many of us down towards the bottom of Maslow’s hierarchy of needs. Sport and entertainment has a key role to play in pushing us back up the pyramid and helping re-build society. To enable this to happen at scale, rights-holders need to develop smart uses of their IP coupled with innovative marketing approaches.

Create a deeper connection with your fans

The re-emergence of sport is hotly anticipated by millions of fans, hungry for a resumption of the content that they are passionate about. With empty or partially filled venues the new ‘norm’, rights-holders will need to explore digital, virtual and remote technology solutions to improve fan experience and engagement.

SmartFan+, a revolutionary fan engagement platform designed to bring the energy to closed door events and enhance the broadcast experience, is one such example. The app connects fans through their smartphone, bringing them together to share in the excitement of an event while simultaneously delivering value for the sporting ecosystem.

Connect with your fans differently

Within the next 18-months the internet cookie will a be thing of the past, creating a new industrywide challenge around targeting and re-targeting of audiences. This seismic shift means brands will be on the search for large and well-understood first party audiences. Rights-holders need to react to this and set themselves up for success by capitalising on marketing and media budgets.

If you’re a rights-holder, this is the time to evaluate the strength of your first party data proposition. Where does it need to be, and what do you have in your armoury to grow this?

Each person in a database represents a commercial value. But how much do you know about their interests, behaviours and preferences? Creating an in-depth understanding of your audience is vitally important. By doing this you can develop meaningful relationships with fans through relevant and personalised communications. If you get that right, the revenue will flow – not just for you but for your partners too.

Again to draw on some of the insights of my colleagues, Ryan Skeggs, UK General Manager of Greenroom Digital shared his thoughts on the digital marketing industry as it is about to go through a period of monumental change, with an estimated 70 – 85 per cent of digital media spend up for grabs. He said that the rights-holders who have a deep understanding of their fanbase and grasp the real value of their 1st party data will be able to generate millions in new revenue streams. The beauty of it all is that they will enhance their fans’ experience, unlock a new revenue stream and start to show tangible results for their clients. Everyone stands to win.

Focus on your most valuable and flexible asset

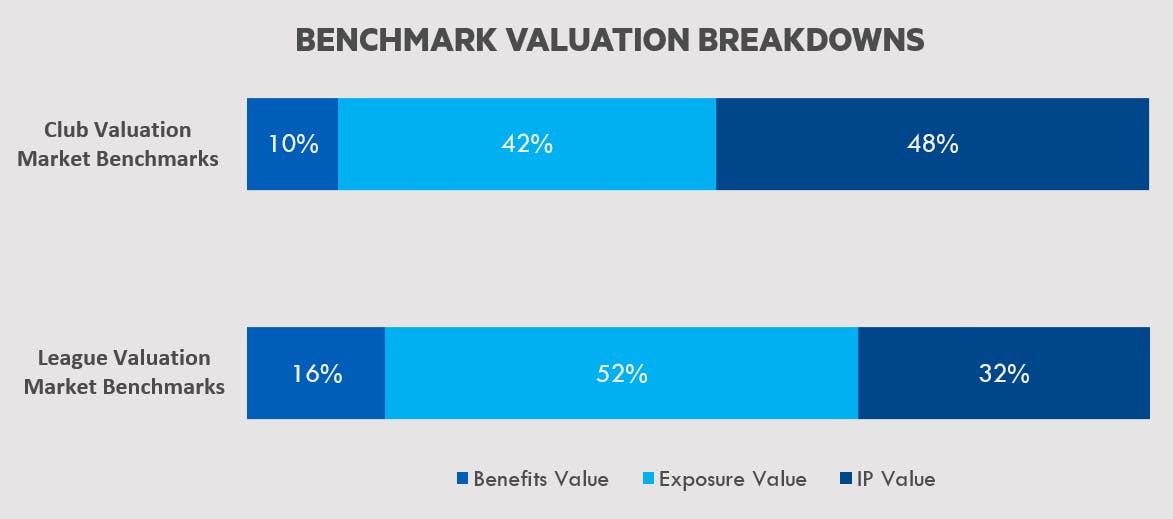

The absence of live sport means many brands are not getting their brand or media value through exposure related assets. Turnstile suggests 52-68 per cent of global deals are skewed to exposure related assets and benefits, such as hospitality.

As the economy begins to shrink so too will marketing budgets, meaning brands will only pay for the rights that drive tangible value. In that climate, it is vital that rights-holders understand and harness the power of their digital and audience assets.

Fortunately, we can now quantify the impact these assets can have for partners. Coupled with our propriety valuation methodology, this enables rights-holders to charge the correct values for these assets.

When I caught up with Tom Huggins, Co-founder of Greenroom Digital he said that the traditional approach to partnerships focuses on assets that are comparable to everyone else in the market, but most are not valuing their audience. Rights-holders must use this time to adapt the model and focus on the one unique asset they have to offer – the IP and unique ability to connect with a large and passionate fanbase. Over the past nine years Greenroom has analysed millions of data-points to compare performance to industry benchmarks, and on average see partnerships deliver a 79-per-cent increase in key marketing performance indicators when this model is in play.

Innovate now, shorten deal conversion and come back stronger

The recent pandemic is presenting difficult challenges for all of us. Now is the time to take stock of current working practices, partnership service offerings and commercial models. These service offerings need to align and integrate better and be receptive to new innovative solutions, to grow incremental revenue streams, provide partnership value and close deals quicker. The rights-holders who can do that will be the ones who will emerge from this crisis in a position of strength.

If you are interested in this and would like to hear more, contact Jason.steele@csm.com