China is less than a year away from hosting the Beijing 2022 Winter Olympic and Paralympic Games, and one of the big questions is how the IOC’s mission to make the Games more accessible for younger audiences and China’s goal of putting 300 million people on ice and snow can be combined? Will the images beamed on live TV, news and digital channels show winter sports as sexy, photogenic, daring and youthful enough to win over a new generation of fans?

To answer that question, it’s useful to look at how the last Olympic Winter Games in Pyeongchang in 2018 were viewed in China. The IOC reported that 244 million people in the country viewed at least 15 consecutive minutes of coverage from the 2018 Pyeongchang Winter Olympic and Paralympic Games, and that 18 of the 20 most highly rated broadcasts involved short-track speed skating. Digital content in China saw 81.2 million hours viewed, almost double that from Sochi 2014.

Looking at sports viewing data from 2018, a pre-pandemic Olympic year, from the exclusive Olympic media rights-holder and state broadcaster CCTV, we can see where audience levels were at their greatest across various mega-events. The highest audience figure of 140 million viewers at the peak were achieved by the Asian Games (hosted in Indonesia) and the Fifa World Cup in Russia. These events were followed by TV viewership of the Winter Olympics (Korea), ITTF World Table Tennis Championships (Sweden) and the FIVB Women’s World Volleyball Championships (Japan), which had broadly similar levels of audience peaks.

Beijing 2022 will have something to offer Chinese audiences that the Fifa World Cup cannot; Chinese Champions, medallists and winners on home soil. So, let’s look at winter sports coverage in more detail.

Highest rated

CCTV’s most highly rated programmes from Pyeongchang 2018 were all short track speed skating. China took silver in the men’s relay final, gold in the men’s 500m final and were disqualified, along with Canada, in the Women’s 3000m relay finals. Some audience ratings peaked at over 100 million viewers per event for the live broadcast primetime. The relevance and reach of the public service broadcaster in this market cannot be underestimated.

For CCTV-5, CCTV’s sports channel, the duration of broadcast figure skating was 38.92 hours representing a whopping 29 per cent of all Games coverage broadcast on the free-to-air channel. Curling was second with 29.10 hours with a strong performance from the Chinese teams including a gold in the Paralympic Games. Snowboard & freestyle skiing came out at 21.83 hours and showed the first snowboard medal with Liu Jiayu taking silver in the half-pipe. Other sports such as ice hockey were aired to the CCTV-5+ digital platform, which has limited penetration and audiences.

Digital first

China has a dynamic and swiftly developing digital media landscape, and coverage of Beijing 2022 is likely to involve the ‘Digital Trilogy’ of Tencent, Weibo and Youku to build on the impressive viewing figures already seen for Pyeongchang 2018.

Tencent

For Pyeongchang 2018, Tencent agreed a sub-licensing deal for clips from CCTV and created their own daily highlights show. It was hosted by various sports anchors, including famous short-track speed skater Liu Qiuhong. Tencent achieved 123 million video plays between studio shows, live and recorded athlete interviews. The most watched was the show with local hero Wu Dajing who had plenty to say about his performance and the judges’ decisions in short track speed skating. Tencent also owns WeChat, China’s most popular multi-purpose social media, messaging and mobile payment app which works well for creating mini fan groups to comment on the programming.

Youku

For the 2018 Games in Pyeongchang, Youku was the video platform rights-holder. It hosted some 15 different video channels featuring many of the world feed-produced events, with CCTV’s commentary, all scheduled on a delayed basis. There were a total of 18.5 million views across the channels, with videos of short track speed skating being the most-watched.

Weibo, which in 2018 had more than 100 million daily users, was listed as the exclusive social media partner in China for the Pyeongchang Winter Games. Under the terms of the deal, the Pyeongchang Olympic Games Organising Committee (POGOC) created an official account on the site to deliver the latest news and content from the Games. The official Weibo channel aired, news, cross-promotions with CCTV-5 and near live video clips, as well as running polls to rank athlete popularity. The result: 2000 posts attracted 335,000 followers, but with an incredible 3.21 billion video plays, 300 million engagements and 5.42 billion topic views.

Which social platforms are attractive to China’s youth?

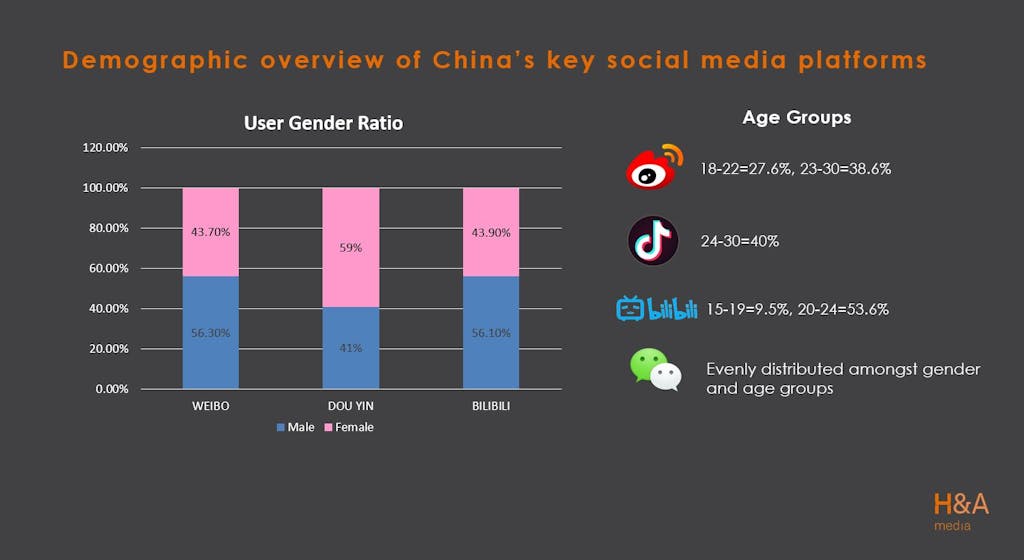

Of the current line-up, it is Weibo that stands out. The platform resembles Twitter’s and Facebook’s newsfeeds the most and offers micro-blogging, trending topics and news. Its content is a mix of real-time trending topics, therefore making it an important place for marketeers, especially at times when Games interest is at its highest. Audience-wise, Weibo has 230 million Daily Average Users (DAU) and 520 million Monthly Active Users (MAU) as of January 2020 (with 65 per cent of users under 30 years old).

Other youth targeted options include Douyin (TikTok) and Bilibili, which is focused more on animation, comics and games.

Another option is Huya Live, which operates China’s largest esports platform. Huya has 130 million monthly active users and has recently started broadcasting winter sports content with relative success. Over the past two seasons, Swiss Ski broadcast all Swiss alpine races (Wengen, Adelboden, Crans Montana, Lenzerheide, Arosa) on Huya Live with expert Chinese commentary, attracting between 500,000-900,000 views per day. The deal, brokered by H&A Media, brings classic winter sports to a younger generation and the chance for dialogue between fans and commentators on-screen as well. This interactive element is vital in the Chinese market when aiming to educate and entertain the audience about a new sporting genre.

Who are the most well-known domestic and international winter sports athletes to Chinese audiences?

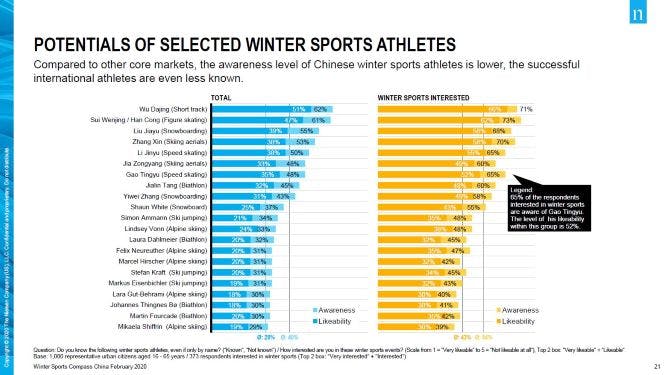

According to the Winter Sports Compass of February 2020, produced by Nielsen, it is domestic athletes who dominate the top 10 most well-known sports personalities in China, although a number of international athletes with a strong media profile do generate interest. Wu Dajing (short-track skating), Sui Wenjing and Han Cong (Skating) lead the awareness and expect to be back competing at the Games in 2022. Liu Jiayu – a silver medallist in Pyeongchang – is listed and she will be joined by two unlisted athletes Cai Xuetong (half-pipe snowboard) and Eileen Gu (freestyle skiing half-pipe and slopestyle). All three are potential gold medallists. Eileen Gu competes in both ski half-pipe and slopestyle, speaks fluent Mandarin and English, has appeared on the cover of Elle China and won double gold at 2021 X-Games. All three have very bright futures as global sporting icons for China.

Also on the list is Tang Jialin who competes in Biathlon, another sport where China’s stated aim is a podium place in Cortina 2026. Biathlon has seen the Chinese team competing on a regular basis and making some progress on the IBU World Cup tour. In terms of awareness in China, Tang is still ranked far above Martin Fourcade, Lara Gut-Behrami or Mikaela Shiffrin. Why do these global names, who are highly visible across European and North American mass media and national sporting icons, still have low awareness in China? How will this change over the next 12 months?

As with every other nation, the people of China are seeking national heroes. This is no different with winter sports, but China is a relative newcomer so the pressure is on.

What are China’s medal prospects for 2022?

Gracenote Sports has been following China medal prospects and according to Simon Gleave, head of sports analysis at the firm: “China has medal prospects in six disciplines of five sports: curling, figure skating, freestyle skiing, short track, speed skating and snowboarding.

“By our calculations, China is not expected to improve on its previous medal count in Beijing as most Olympic host nations do. The Gracenote Virtual Medal Table for Beijing 2022 currently projects eight medals for China, one fewer than the country’s total in 2018,” added Gleave.

Working with various winter sports disciplines over the past year, H&A Media believe that medal tables will be exceptionally difficult to predict, given the unevenness of training and competition experience, not only for the Chinese but for all nations.

As Joseph Fitzgerald, ex-FIS race director and advisor to Beijing 2022, said: “What China needs is the three magic ingredients: a home athlete, standing on the podium, on a sunny day.”

It all sounds so simple.

Referenced articles from the public domain of the Chinese internet or from international sources:

Nielsen China Winter Sports Compass – January 2020

CSM Pyeongchang Winter Olympics research for CCTV – June 2018

iMedia audience and advertising research November 2018

Gracenote Sports Virtual Medal Table – March 2021

IOC’s Pyeongchang 2018 Marketing Report – 2018