In an article published a year ago in SportBusiness, as the pandemic began to bite hard on the sports sector internationally, I wrote of the likely surge of interest from private investors in the sports sector. The sudden loss of revenues and uncertainty as to their return shook the commercial foundations of sport and accelerated a change of attitude amongst rights owners to the concept of partnerships with private equity (PE) investors.

Despite the savaging that sport has suffered in the last 15 months and some negative market data (such as the ongoing decline in traditional TV sports rights values), at least some PE players seem finally to have accepted that sport is an investable asset.

Investment deals in the last year in sports as diverse as football, rugby and volleyball have heralded a new era. A transforming and disrupted industry has increasingly opened its doors to PE investors, both to help mitigate the damage caused by Covid, and to assist in creating a more stable and commercially innovative platform for future growth.

Sport is not a standard business. It is more akin to a multifaceted organism with commercial value. As investors are finding out, a strategic and creative approach, combined with a long-term view – and an abundance of patience and persistence – is often essential for securing a successful partnership with sport.

Private investment in the industries that support sport has been well established for a long time. Media, sports industry suppliers, apparel brands, betting companies and sports equipment manufacturers have long been funded by PE and the capital markets. Ultra-high-net-worth individuals (UHNWs) and latterly PE funds have bought into many of the top football clubs and US sports franchises, attracted by their committed fanbases, contracted commercial revenues and growing international brand value. In many cases, however, the concentration of risk on the continued success of a single asset is too great for institutional money from PE.

PE investment in sports and competitions

A more recent development, however, is the investment by PE players into sports and their competitions themselves. National federations (such as the New Zealand and South African rugby unions), leagues (such as, in football, the Italian Serie A and the German Bundesliga), have all been in negotiations with private equity players, in the wake of CVC Capital Partners’ investment into the Six Nations rugby tournament and Kosmos’ investment in the International Tennis Federation’s Davis Cup team competition.

Although sport can be a complex asset for financial investors to engage with, they are nonetheless attracted to the sustainable value inherent in consumer demand for sports content. By investing at a strategic and structurally ‘senior entry point’ in a sports vertical, such as a league or governing body, PE can spread their investment risk more widely, and actively participate in the development of the commercial platforms of sport and events. This is a step change in the evolution of sports investment, bringing not just capital but new thinking, professionalism and ways of doing business into the heart of the sports sector.

With the convergence of sports, fitness, data, health and social media also continuing at pace, the early-stage tech scene around the sports sector has never been more buoyant and diverse, with extraordinary technology developments and products, unthinkable just a few years ago, now becoming a reality.

And it is perhaps those sports which recognise the shift to a ‘direct-to-consumer’ model for sports themselves, who will reap the benefits in a rapidly changing market.

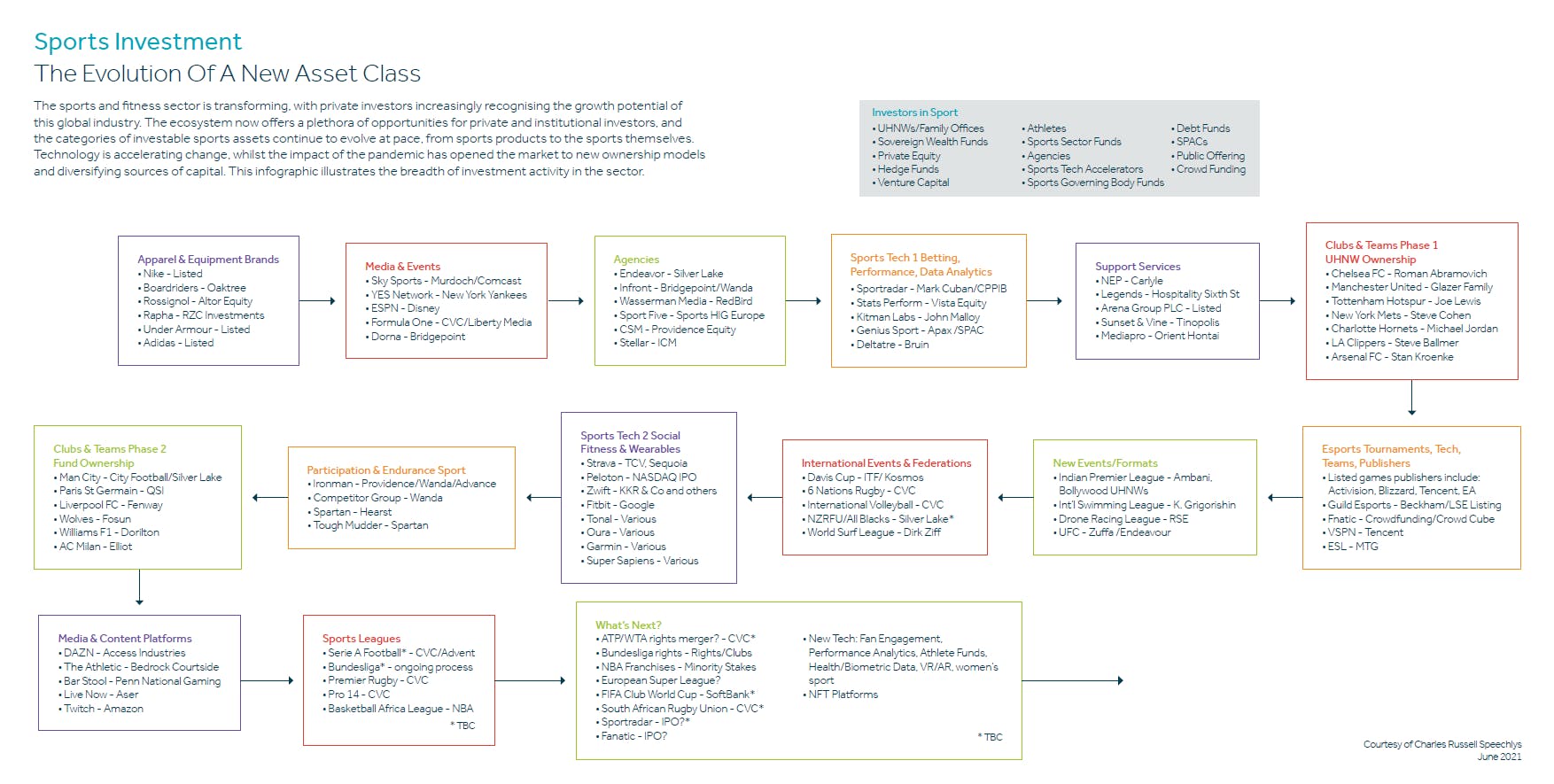

As the infographic [below, click to enlarge] shows, there is now an extraordinary breadth of subsectors and types of investment opportunities across sport and fitness, which has now truly become a distinct investment asset class in its own right.

Scaling up

Scaling up

Several established and new suppliers to the sports sector have taken advantage of the wall of money available from PE and IPOs to tech-centric businesses with large current or future portfolios of sports-related IP and data assets. The focus has especially been on companies with fan engagement solutions, betting rights, and/or content distribution. Some companies, such as Sportradar, have sought investment in order to scale up their businesses and build war chests for rights acquisitions.

Consolidation and M&A will undoubtedly follow, as the key players position for longer-term market share in a global market, whilst the ‘people businesses’, such as the traditional agencies, band together to provide multi-disciplinary support to a more sophisticated and demanding sports client base.

At the time of publication, in the UK, broadcaster BT Sport is for sale, with DAZN, Amazon and Disney all seen as potential strategic investors. And sports themselves are looking at mergers of their commercial interests, driven by PE strategy, such as the discussions in tennis between CVC Capital Partners, the ATP and the WTA.

Sports themselves have also become investors, leveraging the value they bring to their commercial partners to achieve capital upside, such as the NFL receiving equity in sports data specialist Genius Sports as part of its partnership deal. Athletes too are leveraging their brand profiles and credibility to secure equity stakes in growth tech businesses.

Managing the stakeholders

A key feature of successful partnerships will be the effective marrying of investor interests with those of the existing stakeholders of sport. This includes the fans – as the aborted launch of the European Super League recently showed, taking sport and its fans for granted in pursuing commercial aims is a big mistake.

Sport typically has a complex, stakeholder model, with multiple interest groups which need to be both understood and carefully managed. The recent dispute over the proposed investment by Silver Lake in the New Zealand RFU, led by the players association, illustrates that in sports transactions there is often more than one decision-maker in practice.

Patient capital

PE groups will find that access to capital alone is rarely sufficient – the decision to allow funding partners into a sport on a long-term basis is a big one, perhaps a once-in-a-lifetime choice for those affected. Those investors that approach their targets well-prepared, with a long- term game plan and due sensitivity to the values and concerns of existing stakeholders, will have the best chance of a successful hearing.

The risks of ignoring PE

Sports organisations are at a crossroads. Many now need to decide whether or not they position themselves to receive third-party investment. Do they pass up an investment opportunity and so risk becoming less and less relevant as better-resourced competitors (both from sports and outside) capture the attention of fans and participants in a new sports economy increasingly moving towards a direct-to-consumer model? Or do they push forward with new investment partners hoping to reach their potential, but risk making ill-conceived, hasty decisions to join forces with investors motivated only by financial returns, with negative long-term consequences?

And a year from now?

Despite the pandemic, the ecosystem around sport remains vibrant and innovative. It is hoped the backing of private equity will help to drive and energise the industry, allowing sports to get back to business as usual, whilst also investing for the new sports economy around the corner.

The world of sport has retained its appeal in extremely challenging circumstances, but its ownership and funding model could look very different in a few years’ time.