The sports industry’s irrevocable move towards a digital future is opening up countless fresh engagement and monetisation opportunities in the space as 2022 arrives, according to Roger Hall, chief executive of virtual advertising technology provider uniqFEED.

Whereas a ‘Netflix of sport’ was once just a commonly outlined ambition in an industry that watched on with envy as the entertainment sector – and its customers – raced ahead with embracing digital consumption, Hall believes sport is now catching up.

Furthermore, this ongoing transition has fundamental implications for business models that have underpinned the enormous growth of the global business of sport over the past generation.

Non-linear consumption

“Sport has been one of the last bastions of linear, but we are seeing a march towards IP (internet protocol) and non-linear consumption,” Hall says.

“Sport has been three to five years behind entertainment in this regard, but it is now catching up and making that transition, and it’s a very important moment for the broadcasters and the associated sports, when you think about the role sport plays in television and particularly pay-TV.

“Sport has always been at the heart of the big pay-TV subscription bundle, so it’s taken sport longer to make that move. Also, IP and OTT (over-the-top) platforms have been improving their latency, which is a highly sensitive matter in sport.”

Hall cites new products like Sky Glass, the all-in-one streaming television that has been launched by pay-TV broadcaster Sky, as an example of how the landscape is changing.

“If the business that was at the heart of the satellite dish is now fully embracing the new world, I don’t think many in the industry will ignore the trend,” he says. “Now literally everything that is being watched in a house can be through IP, from the phones to the tablets to the smart-TVs, and there is no noticeable difference in terms of the quality of the output.”

Creativity

The creative opportunities associated with the transition to digital in sport will continue to drive the integration of the second-screen experience into the primary screen in 2022 and beyond, Hall adds.

Of course, the pandemic has played a role in accelerating these trends, especially in terms of enhancing the appetite for on-demand streaming services. Netflix, for example, added more than 36 million subscribers worldwide in 2020, to surpass the 200 million threshold.

“Consumption habits have been changing for some time, but as we move deeper into the digital world, the opportunity to do more with the content will be more natural on an IP platform – from enjoying different camera angles and viewing options to personalising the whole experience,” Hall continues. “We’re going to see more and more of that and, instead of a second-screen experience, more of an integrated, primary-screen experience.”

This level of personalisation offers substantial opportunities for a provider like uniqFEED, which is able to explore ways of enabling hyper-targeted virtual advertising to be delivered to viewers as part of their live sports coverage, on top of the broader geography-based segmentation.

A fresh alternative

Although Hall does not envisage a collapse of the traditional linear model, he foresees the dawn of an era in which digital delivery of live sport can provide rights-holders and multimedia companies with a common alternative option for engagement and monetisation.

“It will be a long-haul development, but if a hyper-targeted approach can be adopted, it can be revolutionary, and it is certainly a concept that we are focusing on,” he says. “Suddenly you would go from being broadly targeted in terms of geography to being highly targeted in terms of making the viewing experience as personal as possible.”

This “revolution” would catapult the influence of OTT to unprecedented heights. It would also herald the next phase for virtual advertising – a sector that has experienced ups and downs over the years, but is now, according to Hall, primed for a significant role in the years to come.

“Virtual advertising has undergone a number of iterations over the years, and not all of them have been smooth,” he says. “There was a hardware-based technology phase with a big reliance on cameras, which suffered from logistical and scalability challenges. We are now in a pure software phase though, and the tech is non-intrusive, so it is tailor-made for remote production methods, which are increasingly common in live sports coverage.

“There is now a very high degree of reliability and quality that the sector could not have achieved even five years ago, and we are now at a point where the benefits of this technology are widely understood and appreciated.

“This year, more rights-holders than ever before from across the whole spectrum have started exploring virtual advertising options as part of their commercial strategies. That shows that we have gone beyond the phases in which the technology was questioned and the market needed to be convinced.”

Reimagining the commercial model

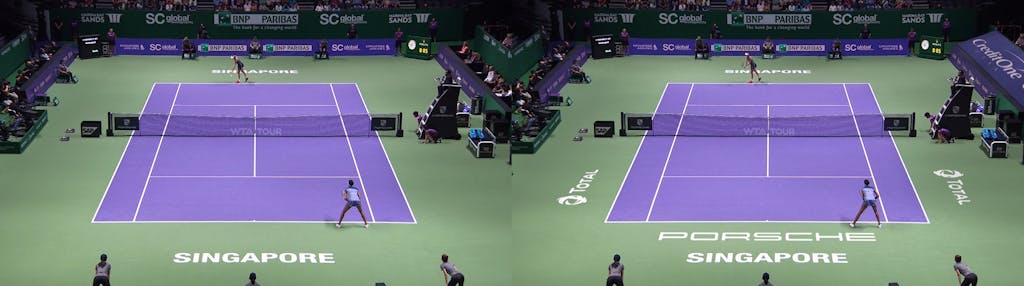

As more properties and rights-holders delve into the possibilities presented by virtual advertising than ever before, companies like uniqFEED are working increasingly across sports like football, baseball and racquet sports like tennis.

However, whilst the technology is sound, the “re-engineering of the established commercial model” for rights-holders is the biggest hurdle before broader adoption of hyper-targeted personalisation through virtual advertising.

“It has taken a while to embrace regionalisation, and it is another step for personalisation, but there will be a natural gravitational pull towards the potential rewards,” Hall explains.

“From a technological perspective, hyper-personalisation obviously represents a challenge as it involves delivering the relevant messaging at the viewer’s end of the process, rather than the distribution end, but this is a big area of focus for providers like us moving forward.”

Crucially, the growth of virtual technology will also enable rights-holders to think differently about how their assets can be used, Hall adds.

“Some sports that may have struggled to penetrate the traditional paid-for rights model maybe now have a greater opportunity to exploit in-game advertising,” he says. “For example, virtual real estate in a sporting arena is a fantastic place for NFTs, which are sweeping the industry at the moment, and even user-generated content, which can drive engagement.

“Traditionally, rights-holders have been restricted to advertising via the real estate in a physical stadium, but virtual assets can connect with viewers in different ways by moving out of the realms of straight branding and into new areas of fan engagement.”