Reports with actionable insight and analysis powered by data

SUMMARY

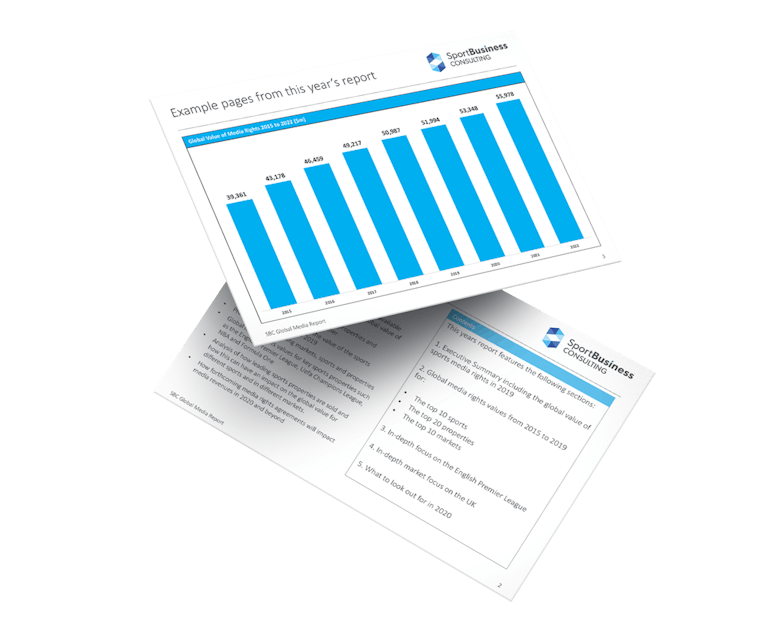

It has been a year unlike any other, for sports media and the wider world. Covid-19’s impact on the industry has been massive, forcing rights-holders almost everywhere into rebates and renegotiations. As a result, the global value of sports media rights – $44.6bn in 2020 – has fallen by just over 12 per cent from 2019. And the 10 most valuable sports generated a combined $41.3bn from media rights in 2020, down from $46.8bn in 2019. Among the top 10, the sports to feel the biggest impact of Covid-19 were baseball (39.1-per-cent down on expected revenues for 2020), US college sports (28.4 per cent), golf (23.7 per cent) and motorsport (20.2 per cent).

TABLE OF CONTENTS

Section 1: Executive summary

Outlines some of the key findings from this year’s research, including defining the value of global media rights this year, as well as looking forward at expectations through to 2023.

Section 2: Most valuable sports

An in-depth look at the 2020 top 10 sports by media rights value through to 2023, including the share of global value, 2019-20 growth rate, the 2020 Covid-related change, and the share of the sport’s most valuable property.

Section 3: Most valuable properties

Highlights the top 20 properties by global media rights value in 2020 as well as an analysis of the top 10 properties, including how each has fared with media-rights rebates this year.

For each property in the top 10, the report looks at the value they would have achieved without any Covid-19 rebates, its share of the global value and property’s most valuable market.

Section 4: Most valuable markets

An in-depth look at the 2020 top 10 markets by media rights value through to 2023, including the share of global value, 2019-20 growth rate, and the 2020 Covid-related change.

As well as the numbers, this section also looks at the key developments and market dynamics of the main players in 2020.

Section 5: What to look out for in 2021

SportBusiness Consultancy looks at five predicted developments in the sports media rights industry next year including:

· The continuing effects of Covid-19

· Private equity involvement in European soccer

· Big new US deals defying wider global struggles

· English Premier League domestic and international sales

· The development of esports media rights

KEY FINDINGS

- How many billions of dollars Covid- 19’s impact has cost on sports media and the wider world.

- How the 10 most valuable sports media rights have been impacted on 2020

- Discover how baseball, golf and US college sports felt the biggest impact of Covid- 19.

- Find out which sport remained the most valuable generating about $18.9 billion in 2020.

- The US continues to be the most valuable sports media rights market, worth $19.5 billion in 2020. Find out what percentage of the global media rights the US holds.

- Find out how the Chinese market, home to many headline deals for international rights-holders over the last years, looks set to decline.

WHY YOU NEED THIS REPORT

Expert analysis from the SportBusiness Consulting team

The most accurate set of media values available anywhere

Understand the key trends across sports, properties and markets

Find out the biggest markets, most valuable properties and popular sports

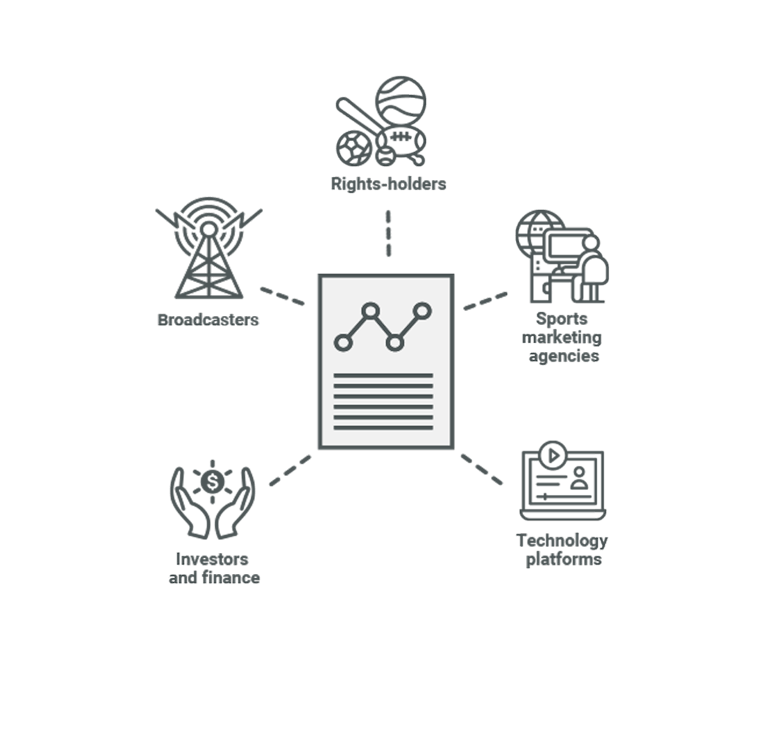

WHO IS THE REPORT FOR?

- Broadcasters – needing an accurate understanding of values for global sports content.

- Rights-holders – looking for global data on how to price property rights.

- Sports marketing agencies – that need comprehensive market analysis to get the best value for their clients.

- Technology platforms – needing to understand the progress of OTT and streaming media rights.

- Investors and finance – wanting an overview of investment viability in sports media rights.

Purchase this report

The most accurate data on global media rights deals, plus peerless insight and analysis, on one easy to use digital platform.

- With well over 12,000 media rights deals going back over 20 years

- The most accurate and independent values and durations for major media rights deals

- Analysis and insight around the deals from a team of global analysts

- Every month we provide a detailed data-led snapshot of a particular, sport, geography or industry

- Subscribers also get access to the annual Global Media Rights Report