Reports with actionable insight and analysis powered by data

SUMMARY

After a 2020 filled with cancellations, postponements and rebates, this year has seen the global media rights industry begin recovering from the economic effects of the pandemic.

The global value of sports media rights – $52.1bn in 2021 – has risen by about $7.2bn since last year, an increase of just under 16 per cent on last year’s Covid affected total. It is also about $1.1bn more than 2019’s total of $50.9bn, underlining the industry’s resurgence.

The sports industry’s recovery from a year blighted by Covid-19 is evident across this year’s Global Media Report. Last year’s renegotiations and rebates have been washed away by waves of new long-term deals, though the recovery has not been uniform across all territories and sports.

As ever, this report breaks down the global market by sport, property and territory. However, unlike last year, the report will not take rebates into account for current or future years.

DOWNLOAD EXECUTIVE SUMMARY

TABLE OF CONTENTS

Executive summary

Outlines some of the key findings from this year’s research, including defining the value of global media rights this year.

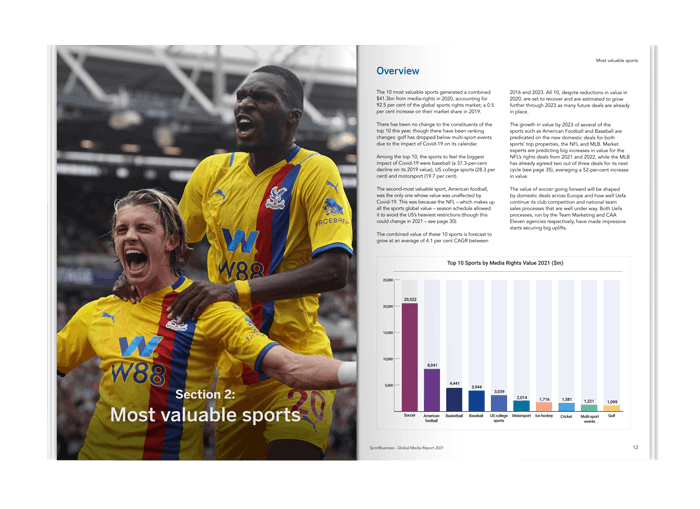

The 10 most valuable sports

An in-depth look at the 2021 top 10 sports by media rights value through to 2024, including the share of global value, 2020-21 growth rate, and the share of the sport’s most valuable property.

The 10 most valuable properties

Highlights the top 20 properties by global media rights value in 2021 as well as expert analysis of the top 10 properties.

For each property in the top 10, the report also looks at its share of the global value and property’s most valuable market.

The 10 most valuable markets

An in-depth look at the 2021 top 10 markets by media rights value through to 2024, including the share of global value and 2020-21 growth rate.

As well as the numbers, this section also looks at the key developments and market dynamics of the main players in 2021.

What to look out for in 2022

The SportBusiness Consulting team looks at key predicted developments in the sports media rights industry next year.

KEY FINDINGS

- Learn how the sports media rights industry has recovered after a year blighted by Covid-19.

- See which key territories and sports have stood out for not recovering.

- Find out the value and percentage growth of the top 10 most valuable sports.

- Discover which properties continue to chase the NFL – the most-valuable sports property globally – and how much of total media rights revenue they each account for.

- Understand which are the most valuable sports markets, their year-on-year value change, and the factors that affect this.

- Learn which major market is predicted to decline in coming year, despite hitting an all-time high value this year.

WHY YOU NEED THIS REPORT

Expert analysis details the factors affecting sports media rights values year-on-year

Accurate values provide the most comprehensive breakdown of media rights

Understand the key trends across the most important sports, properties, and markets

See where the growth lies as last year’s renegotiations and rebates have been washed away by waves of new long-term deals

WHO IS THE REPORT FOR?

- Broadcasters – needing an accurate understanding of values for global sports content.

- Rights-holders – looking for global data on how to price property rights.

- Sports marketing agencies – that need comprehensive market analysis to get the best value for their clients.

- Technology platforms – needing to understand the progress of OTT and streaming media rights.

- Investors and finance – wanting an overview of investment viability in sports media rights.

DOWNLOAD AN EXECUTIVE SUMMARY

Data from SportBusiness Media

The most accurate data on global media rights deals, plus peerless insight and analysis, on one easy to use digital platform.

- With well over 24,000 media rights deals going back over 20 years

- The most accurate and independent values and durations for major media rights deals

- Analysis and insight around the deals from a team of global analysts

- Every month we provide a detailed data-led snapshot of a particular, sport, geography or industry

- Subscribers also get access to the annual Global Media Rights Report