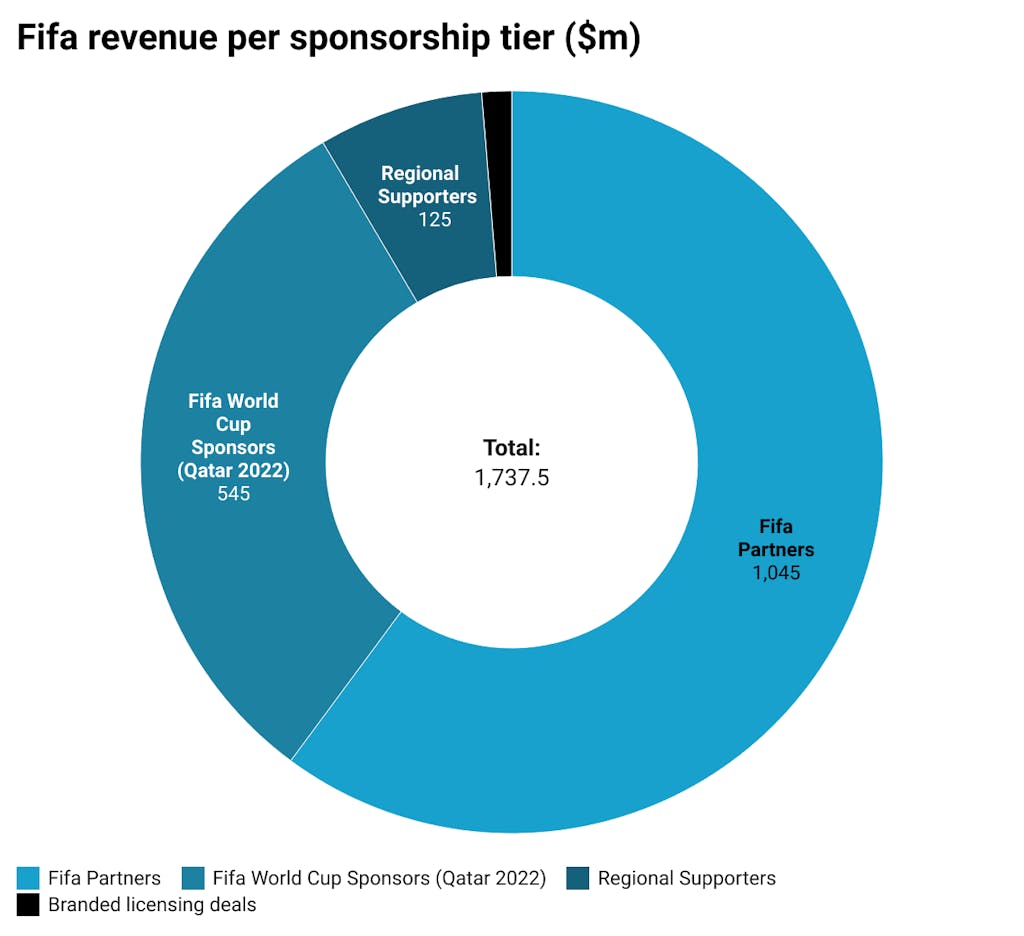

Analysis by SportBusiness Sponsorship indicates Fifa has generated around $1.74bn (€1.67bn) in sponsorship income during its four-year sales cycle, culminating with the current World Cup in Qatar, a more than 4.6-per-cent increase from the previous four-year period when it generated $1.66bn from the sale of its sponsorship rights.

The increase is largely thought to have been driven by the global federation’s World Cup Sponsor tier, where revenues have risen from $363m in the last cycle, to around $545m this time.

There has been very little movement in the top Fifa Partner category, which grants sponsorship rights across all of Fifa’s men’s, women’s and esports competitions, with Qatar Airways having joined the tier in 2017 and most of the other brands in the category having agreed extensions ahead of the previous cycle (from 2015-18). Revenues across the Fifa Partner tier stood at $1.05bn across the current four-year cycle.

A late flurry of deals in Fifa’s third ‘Regional Supporter’ tier prompted the governing body to claim a full roster of sponsors for the current World Cup in Qatar, although the late cancellation of blockchain company Algorand’s Regional Supporter rights in Europe and the USA appears to leave the category two brands short of the maximum of 20 sponsors. SportBusiness Sponsorship analysis indicates Fifa generated $125m in revenues from this tier.

For a full analysis of every sponsorship deal in this cycle, click here.

The sales effort for the Regional Supporter tier in Europe is understood to have been hampered by brands having residual misgivings about Fifa following the various corruption scandals in the previous cycle.

Similarly, agency sources say reservations about Qatar’s human rights record have prompted some sponsors to change their customary approach to activating Fifa sponsorship deals. While some major brands have been barely visible, others are activating in ways that maintain an association with football and the World Cup but elide any references to Qatar.

The next cycle

In light of this, Fifa can be forgiven for having one eye on the 2026 event, to be co-hosted by the more attractive markets of the US, Mexico and Canada. Industry sources say the governing body will almost certainly secure a big uplift in the value of its sponsorship rights for the 2023-26 cycle but that it will struggle to achieve the kind of increase Fifa president Gianni Infantino has mandated from his commercial team.

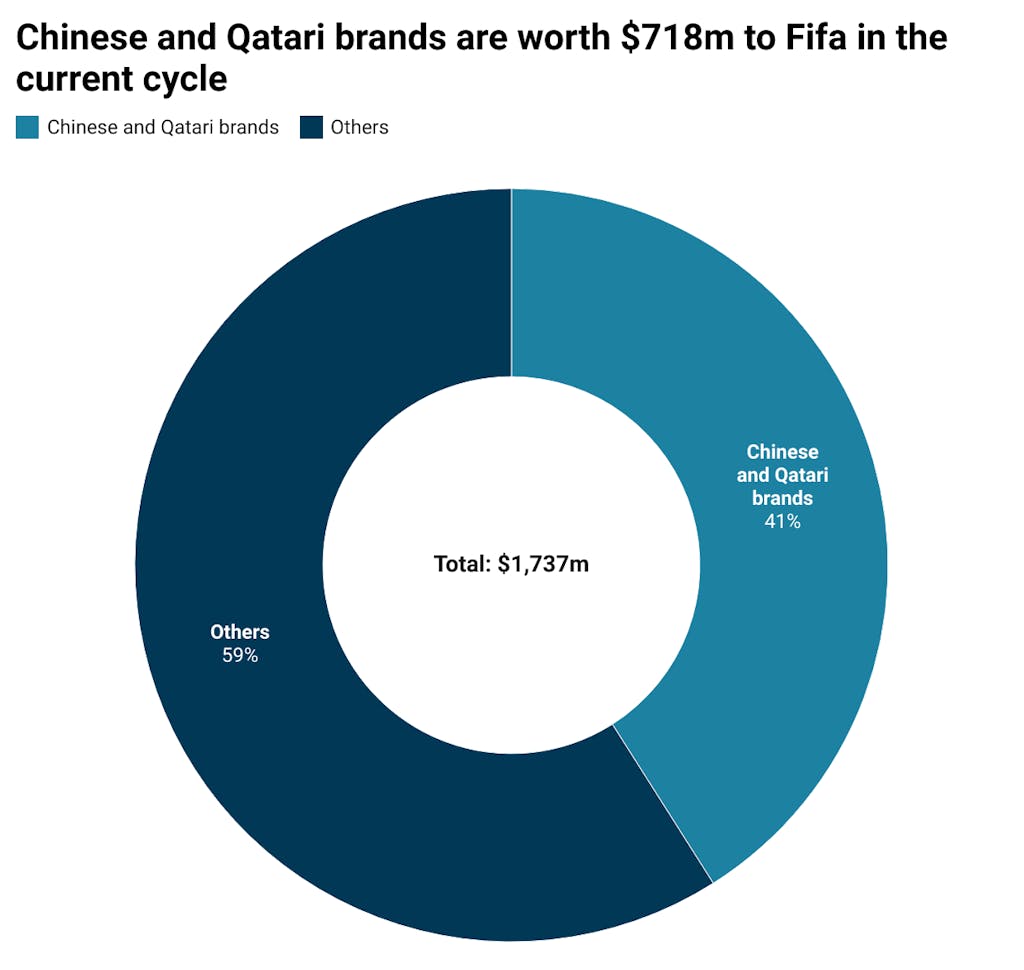

Set against the appeal of the Americas, the global football federation is facing headwinds in the shape of a global recession. There is also likely to be less inclination for Chinese and Qatari brands to sponsor the governing body in the next four-year period.

Investment from brands in the two countries account for $718m out of the current cycle total of $1.74bn. Of this, only the $180m-per-cycle paid by China’s Wanda group conglomerate is certain to appear in the accounts for the next four-year period because the deal doesn’t expire until after the 2030 World Cup.

One growth area that looks resistant to the economic downturn is sports betting, which is growing exponentially as states across the US enact legislation to legalise it, following the striking down of federal restrictions by the Supreme Court in May 2018. Fifa has already tested the water in the current cycle by agreeing a Europe-facing Regional Supporter deal with Greek betting brand Betano, the first time it has struck a sponsorship agreement with a gambling brand.

For all of SportBusiness Sponsorship’s Fifa World Cup coverage, click here.

Fifa projections

At its 2020 Congress, Fifa projected $6.44bn in revenues for the 2019-22 cycle and predicted broadcast rights revenues of $3.3bn. Sponsorship rights were budgeted to raise $1.77bn, ahead of licensing rights ($603m) and hospitality rights and ticket sales ($508m).

However, the governing body recently projected that it will earn $7.5bn from the current rights cycle, more than $1bn greater than its original revenue target.

Taking out the sponsorship income of $1.74bn reported by SportBusiness means the governing body will have to generate $5.76bn from its three remaining revenue streams to reach the $7.5bn figure.

In the last cycle from 2015-18, Fifa generated $712m from hospitality rights and tickets sales and $600m from the sale of licensing rights. A further $322m was delivered by ‘other revenue’, which included income generated by the Fifa Club World Cup and income from the sales of film and video rights.

Earlier this year, the governing body’s accounts revealed it generated $320m in ‘other revenue’ in 2021 alone. The figure included $60m from the US Department of Justice as compensation for corruption carried out by former officials.

The remaining $260m came from sources including the Club World Cup in Qatar at the beginning of the year; break fees relating to contract cancellations; gains from property sales; proceeds from the Fifa Museum in Zurich; and income from the sale of archive footage and video rights.

The same accounts showed the governing body generated $180m in licensing in 2021, thanks to an expanded merchandise licensing programme for the World Cup in Qatar and new e-commerce opportunities.