The global value of sports media rights has increased to just under $56bn (€51.1bn) despite another year of turbulence in which cornerstones of the industry came under threat.

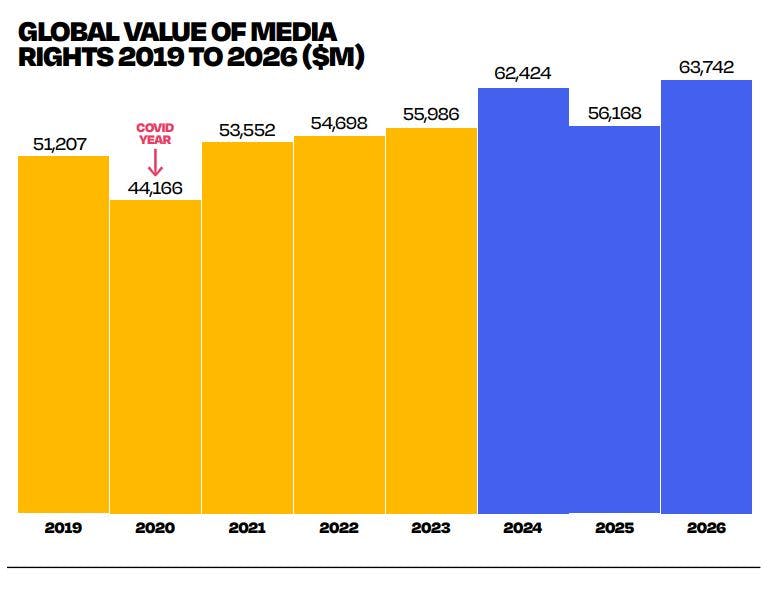

SportBusiness’ newly published Global Media Report 2023 reveals the combined worldwide media rights value of all sports properties has climbed to $55.986bn over the last 12 months, up 2.4 per cent from $54.698bn in 2022.

The value is expected to pass $60bn for the first time in 2024 as the return of the Olympic Games and Uefa European Championship add weight to the total.

The increased global value of sports media rights comes in spite of intensifying debate over the viability of the pay-television bundle and regional sports networks in the US. There are also concerns over the financial health of the sports media industry in Europe as increasingly tough macroeconomic conditions take their toll on media groups such as Viaplay.

As in previous editions, the report breaks down the global value of sports media rights by sport, property and territory. All of the data within the report comes from SportBusiness Media’s Rights Tracker, the most comprehensive database of rights deals in the world.

Football remains by far the world’s most valuable sport by media rights revenues, generating $19.183bn this year, with American football and basketball making up the top three.

However, it is cricket that has seen the biggest percentage increase as the commercial growth of the sport in India continues to drive its media revenues upwards.

This year marked the first year of the Board of Control for Cricket in India’s five-year deals with pay-television broadcasters Disney Star and Viacom18 for Indian Premier League rights. The deals are worth a total of INR48,390 crore ($5.8bn/€5.3bn) over five years.

As for individual properties, the English Premier League and Uefa club competitions are nestled among the big four US leagues and the IPL at the top of the pile. The most valuable property is still the NFL, with its global media rights value of $12.433bn.

The top 10 properties make up a growing proportion of the overall total, as middle- and lower-tier properties struggle to secure rights deals and broadcasters increasingly turn to content that is guaranteed to attract large audiences.

The US is still the beating heart of the sports media industry, with the territory accounting for 49 per cent ($27.521bn) of global media rights revenues, up from 45 per cent last year.

Meanwhile, the Indian subcontinent has shot up the global rankings, overtaking four of the ‘big five’ European markets of France, Germany, Italy, Spain and the UK.

Callum McCarthy, SportBusiness Editor in Chief, said: “The global value of sports media rights has increased to just under $56bn and will pass $60bn in 2024 thanks to the Olympic Games in Paris and Uefa Euro 2024. This growth is occurring despite years of turbulence that began before the Covid-19 pandemic as media businesses run toward profitability rather than expansion.

“Most European football leagues are struggling to grow their media revenues beyond current levels, but global sport reaches far beyond five leagues in five countries. Properties such as the NFL, NBA, Uefa Champions League, Formula 1, IPL and WWE are performing strongly and will continue to do so throughout the decade, and major sporting events such as the Fifa World Cup and the Olympic Games are still yet to reach their peak commercial potential.”

The 2023 Global Media Report is available to buy now.

To download the executive summary, click here.